VAT is a notoriously complex subject, so we recommend speaking to your accountant if you’re unsure about anything in this area. HMRC provides more information about VAT and disbursements on its website.

If you’re VAT-registered, you may be able to treat disbursements as outside the scope of VAT on your invoices and not charge your customers VAT on them if certain criteria are met. If you choose to pass the cost of a disbursement on to your client, you should add it to your invoice in the same way you would add an expense. a plumber buying a bathroom sink for a customer’s project) it may be a disbursement. a train ticket purchased to visit a client) it’s usually an expense if the item is something that you buy for your customer and your customer uses (e.g.

In broad terms, this distinction depends on who ends up using the product or service that the business has bought. There are certain types of costs that are known as ‘disbursements’ rather than ‘expenses’. The difference between expenses and disbursements If your customer is also registered for VAT, then they might be able to claim back the VAT you charged them when they file their VAT return for the quarter.

This is because when you recharge the cost to your client, you are the one supplying the service (as opposed to the train company supplying the service to you).

#Incurred expenses invoice plus

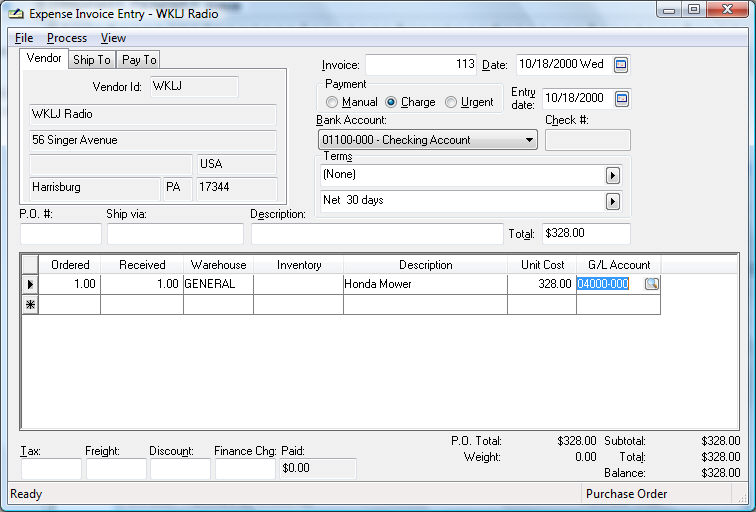

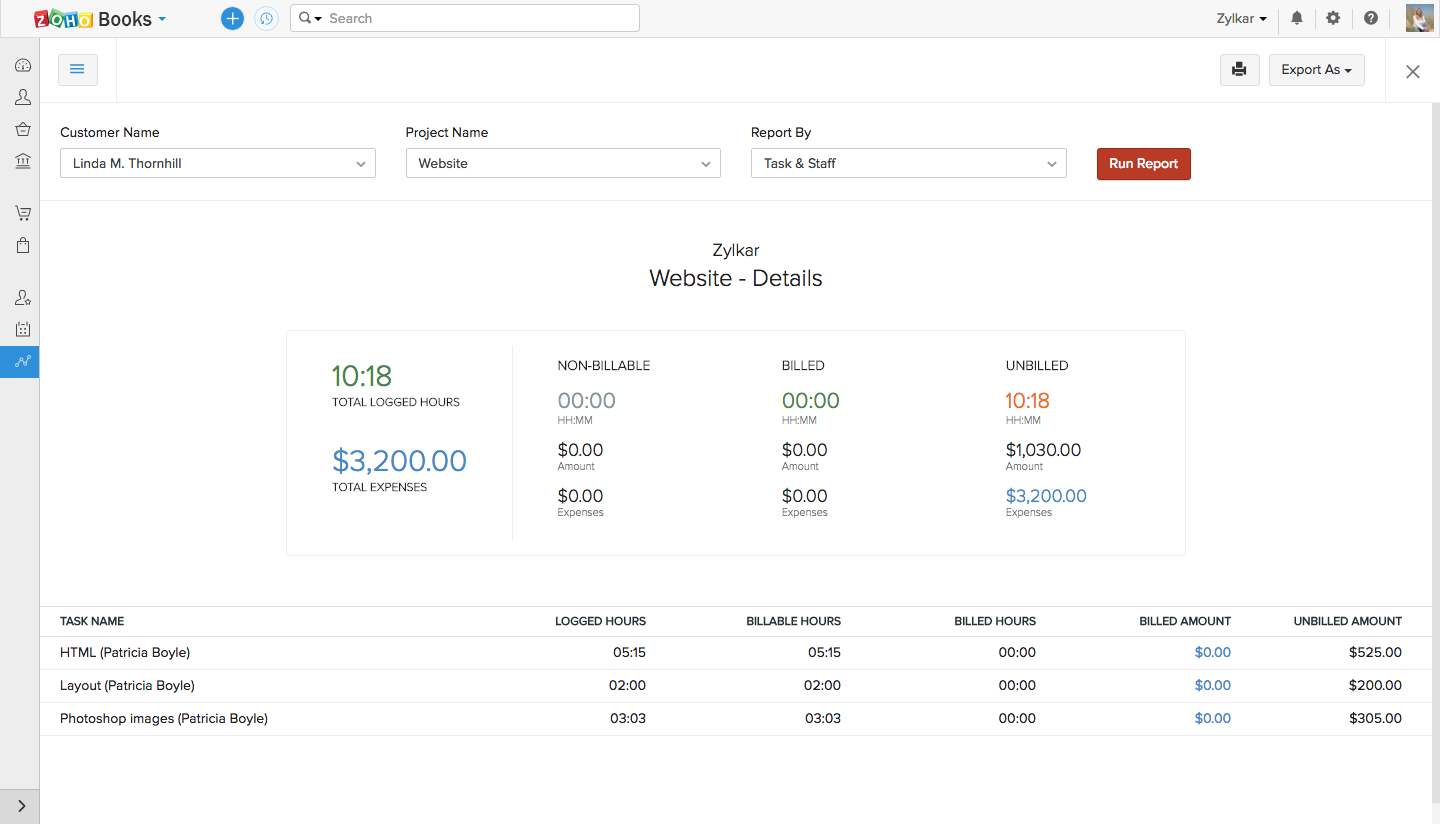

This means that if you wanted to invoice your client for a train ticket that cost you £50, and you want to recharge it at the same price, you need to charge £60 (£50 plus 20% VAT). If you bought an item that was zero-rated for VAT, such as a train ticket, you’d still need to add VAT to the cost when invoicing your client. If your business is registered for VAT and you incur an expense that you want to include on an invoice, you have to charge VAT on that expense at the rate you usually charge for your services.įor example, if you stayed in a hotel that cost £120 + VAT while visiting a client to provide a training session, you could simply add the £120 + VAT as a new line on your invoice. Make sure that you’ve agreed this with the client in advance, so they know what to expect when they receive the invoice. In this situation, you should include both the price of the product or service you delivered and the expense as separate line items on the invoice. If your business isn’t registered for VAT, invoicing your clients for expenses is often as simple as adding an expense as a line on an invoice.

#Incurred expenses invoice how to

How to add an expense to an invoice If you’re not registered for VAT Here we explain how to add expenses to your invoices and some additional factors you might need to consider when you do so. When a business cost is passed on to the customer in this manner, it's often referred to as an ‘expense’. For example, if you provide training sessions and you have to buy a train ticket to travel to a client’s office, you might want to include the cost of the ticket when invoicing the client for the session. In some situations, you might want to invoice a customer for a specific cost you incur in doing business with them. 10 December 2021 How to invoice your clients for expensesĪs every small business owner knows, there are a variety of costs that you might incur in the process of supplying your goods or services to a customer.

0 kommentar(er)

0 kommentar(er)