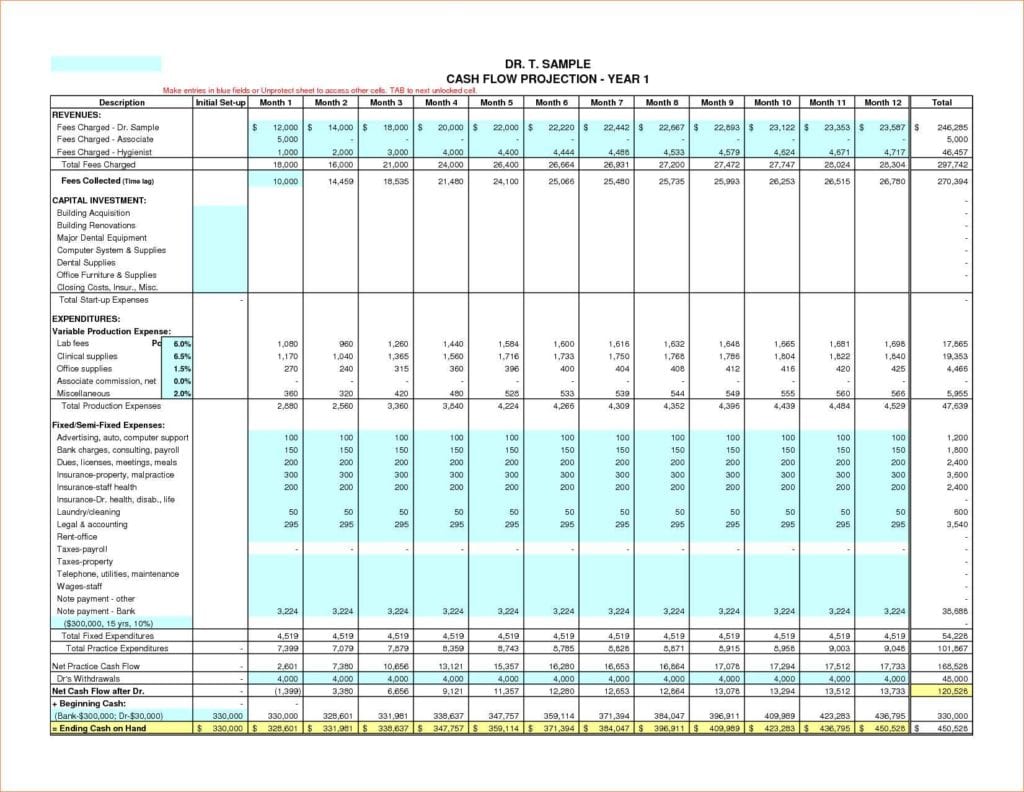

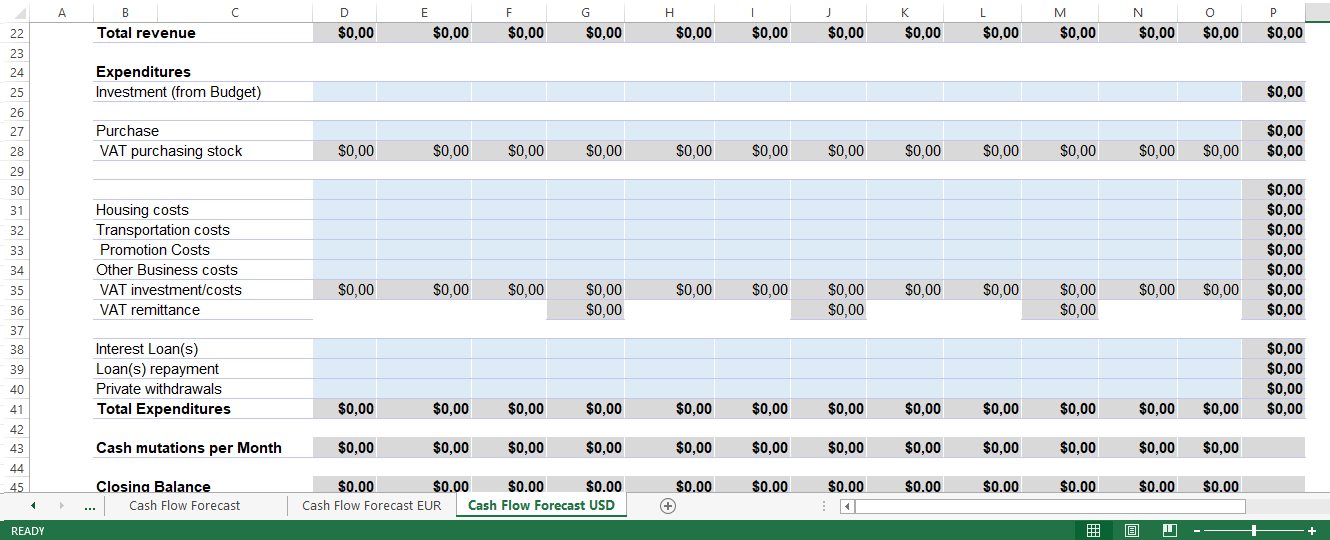

Are material costs rising because of supply chain issues? Will you pass those costs along to your customers? These are examples of considerations for calculation adjustments.Ĭonsider which Drivers influence other Drivers. Once Drivers and KPIs have been identified, use historical data, current or future pricing, geopolitical factors, and expansion or retraction plans to determine the budget period calculations. Other KPIs such as Cost of Sales might be a ratio of an expense line to a corresponding revenue line. Some KPIs can be derived by simply dividing revenue and expense line items by corresponding Drivers of those lines. Next, calculate your organization’s key performance indicators (KPIs) based upon past actual results. Break down what non-financial metrics drive your various revenue and expenses and list them.

Cpe cashflow forecasting driver#

Employee headcount might be a driver for a professional services firm. Number of tickets would be a Driver in a restaurant. The definition of a Driver may be better served with a few examples: total members, new members, and account cancellations would be Drivers in a subscription-based business. Drivers are the key metrics that allow for revenue and expense expectations. How: It’s all about DriversĪll budgeting and forecasting should start with the identification of Drivers. Make sure management is privy to staff suggestions and approve information submitted by their subordinates.

Schedule multiple follow-ups to initial meetings. The budgeting process is exactly that: a process. Representatives from the finance department should suggest, maintain, and approve budget metrics, but successful plans include input from department managers, sales people, and other staff who have influence on actual results of the organization. There is better buy-in to budgets and forecasts when the metrics are considered reasonable by those responsible for the budget. Balance accuracy with proactivity based upon your individual business scenario.

Keep in mind that the more recent actual results data you have in hand, the more accurate your plan becomes. Budgets should be considered a tool and not written in stone. Serve as an objective criterion for staff bonusesīudgeting and Forecasting can take place at any point preceding a financial period or can even happen in the period itself.Serve as a performance benchmark for investors and other equity holders.Most importantly, they can help owners, managers, department heads, and any other stakeholders make decisions based upon capital needs.Have you ever heard the adage “Failing to plan is planning to fail”? Would you go on a vacation without forming some sort of plan ahead of time? Would you buy a house without having a range on the purchase price in mind?īudgets and forecasts serve several purposes:

Cpe cashflow forecasting how to#

In this article we will discuss how to get started. Most small business needs for budgeting and planning usually fall somewhere in-between. On the simple side, budgets are used to plan and fund a project, or can be as advanced as a multi-scenario five-year cash flow projection of a multi-billion-dollar corporation. Budgeting and Forecasting is traditionally defined as a documented estimate of revenue and expenses over a future period. What is Budgeting and Forecasting? This seems like a simple question on the surface.

What can we do to project the success of our business?

0 kommentar(er)

0 kommentar(er)